Medigap Plan High Deductible G (HDG)

Medicare Supplement Plan HDG

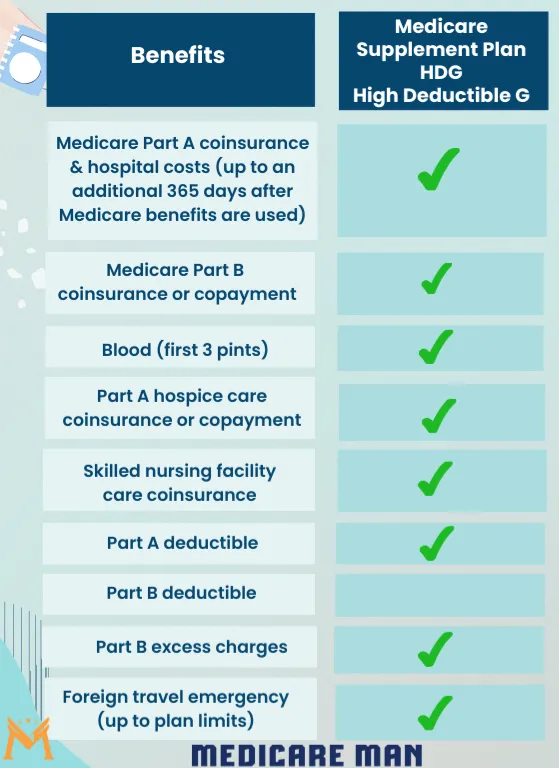

High Deductible Plan G offers the same benefits as standard Plan G — but with a lower monthly premium and a higher annual deductible. It’s an excellent choice for those who want comprehensive Medicare coverage but prefer to pay more out-of-pocket before their coverage kicks in.

Just like standard Plan G, High Deductible Plan G does not cover your Medicare Part B deductible. In addition, you must meet the annual plan deductible before the plan begins paying your Medicare cost-sharing.

Once you met the annual deductible plan, High Deductible Plan G covers the following at 100% with the exception of the foreign travel emergency benefit:

Original Medicare Part A’s deductible

Part B excess charges

Part A coinsurance and hospital costs up to an additional 365 days after Medicare’s benefits are all used up

Part B coinsurance or copayments

First three pints of blood used in an approved medical procedure

Skilled nursing facility coinsurance

80% of a foreign travel emergency (up to plan limits)

Key Details To Know:

-You are responsible for paying the annual deductible (set by Medicare each year) before the plan begins covering costs.

-After the deductible is met, coverage is identical to standard Plan G.

-Monthly premiums are typically much lower than standard Plan G.

High Deductible Plan G can be a smart option for healthy Medicare beneficiaries who want strong protection against large medical bills, but don’t anticipate frequent doctor or hospital visits.

Get a Consultation

& Quote at No Cost

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800 MEDICARE to get information on all of your options.

Help Me Medicare Man Copyright 2026 -- All Rights Reserved --